Crypto Tax Rules Are Changing in 2025: What You Must Know and How to Stay Ahead

- Carina Luo

- Jun 15, 2025

- 3 min read

Updated: Jun 22, 2025

With wallet-by-wallet accounting, new IRS forms, and stricter tracking, 2025 marks a pivotal shift in digital asset taxation. Here's how to stay ahead of crypto tax complexity.

As digital asset adoption surges, the IRS is dramatically tightening its crypto tax rules starting January 1, 2025. From mandatory wallet-by-wallet reporting to the new Form 1099-DA, crypto investors, traders, miners, and DeFi users must prepare now to stay compliant—and save thousands in potential taxes.

1. Crypto Is Still Personal Property—And Taxable

The IRS continues to treat crypto as personal property, not currency. That means every sale, exchange, or transaction involving a digital asset is a taxable event - just like selling stocks.

Taxable events include:

Receiving crypto as payment for goods or services

Earning rewards from staking, mining, or airdrops

Exchanging one crypto for another

Selling crypto for fiat or other assets

Not taxable:

Simply holding crypto

Transferring between your own wallets or accounts

Buying crypto with USD or other real currency

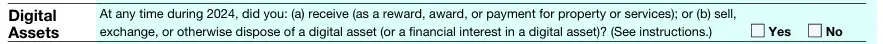

If you had any taxable event in 2025, you must check “Yes” to the crypto question on Form 1040.

2. Universal Ledger Is Dead: Wallet-by-Wallet Accounting Begins 2025

Starting in 2025, the IRS requires taxpayers to calculate cost basis separately for each individual wallet or exchange—no more aggregating all crypto transactions into one unified ledger.

Under Rev. Proc. 2024-28, if you've been using a universal accounting method, you can transition to wallet-by-wallet reporting without risk of audit—but only if you do the following:

Prepare a Safe Harbor Plan that explains how you’re reallocating cost basis by wallet

Sign and date the plan before January 1, 2025

Keep it on file for your records (there’s no need to submit it to the IRS)

3. FIFO Is the Default Accounting Method

The IRS now requires First In, First Out (FIFO) accounting by default. You can no longer switch to LIFO or HIFO after the fact unless you pre-identify assets before the sale.

That means:

You’re selling your oldest holdings first, possibly at the lowest basis

You must notify your exchange in advance to use specific identification

This doesn’t change your overall tax, but it does affect when you recognize gains

4. New IRS Form 1099-DA Begins January 1, 2025

The IRS has released Form 1099-DA: Digital Asset Proceeds from Broker Transactions.

Effective January 1, 2025

Applies to digital asset brokers (centralized and some DeFi platforms)

Reports gross proceeds of crypto sales

Form 1099-DA aims to improve reporting transparency and reduce underreporting of crypto income. Review it carefully against your own records.

Key Strategies to Navigate Crypto Taxes in 2025

Stay compliant and lower your tax liability with these essential 2025 strategies:

Hold long-term: Benefit from lower capital gains tax rates by holding crypto for over a year.

Harvest losses: Use year-end tax-loss harvesting to offset gains—wash sale rules don’t apply to crypto (yet).

Use retirement accounts: Trade within IRAs or other tax-deferred accounts to grow crypto tax-free or tax-deferred.

Donate crypto: Contribute appreciated assets to a qualified charity and deduct their full fair market value.

Use a CRT: Defer capital gains and generate income by contributing crypto to a Charitable Remainder Trust.

Borrow instead of sell: Tap into your crypto’s value using a collateralized loan to avoid triggering a taxable event.

Final Thoughts

The IRS is sending a clear message: crypto tax rules are real—and evolving. Smart crypto investors aren’t just compliant—they’re strategic.

Need help preparing for the 2025 crypto tax overhaul? Book a strategy session with LightUp Tax today—before January 1, 2025.

Reach out to LightUp Tax today to schedule your consultation and

secure your spot for 2025 tax compliance and planning!

Comments